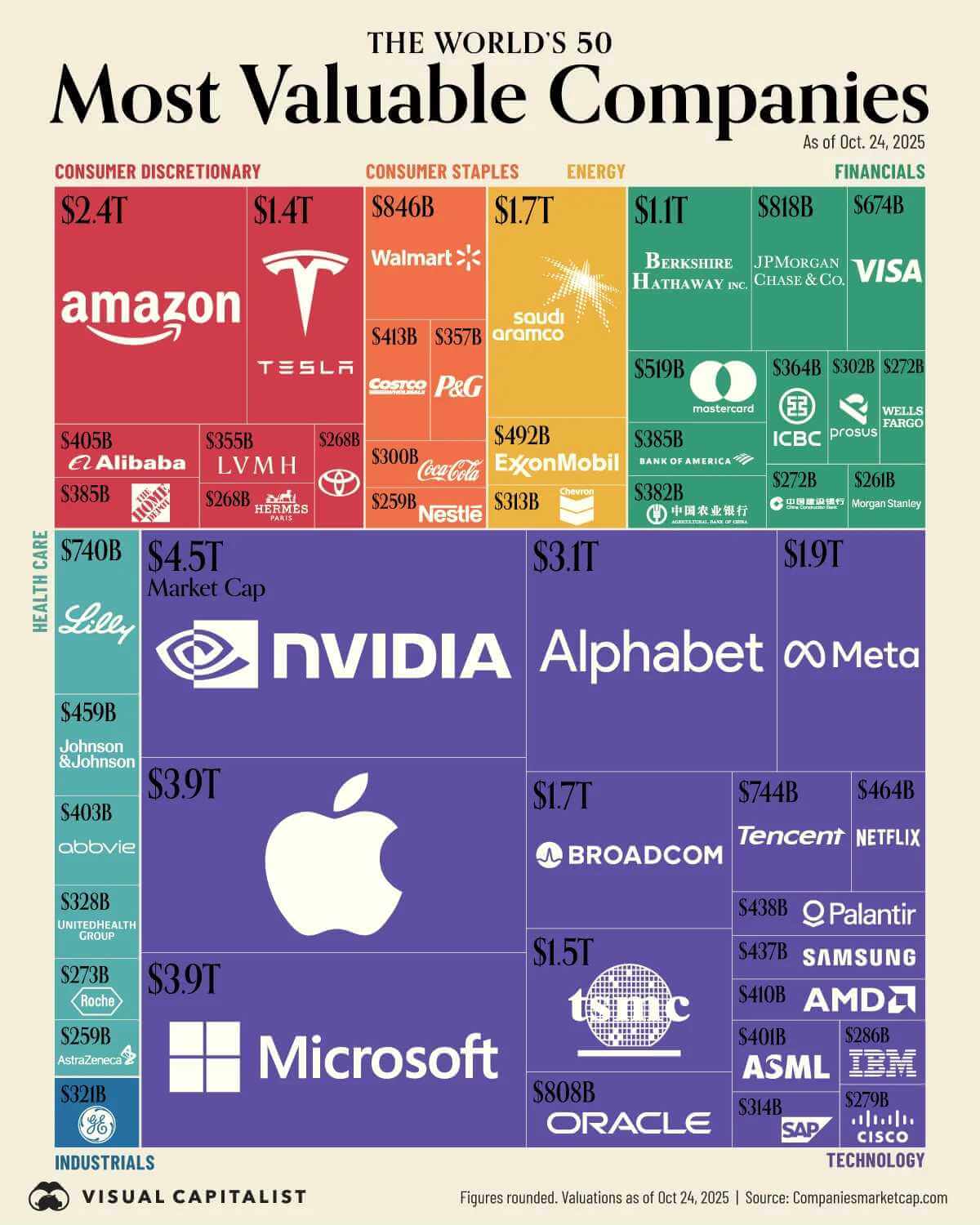

The world’s most valuable companies have continued to grow larger in 2025, with the tech sector’s prevalence more profound than ever. Nvidia has pulled ahead of the rest of its Magnificent Seven peers, nearing a historic $5T valuation.

The AI boom isn’t lifting one stock. It’s reordering the entire global economy.

In October 2025, Nvidia became the world’s most valuable company at $4.53 trillion, surpassing Apple and Microsoft. That’s more than the entire GDP of the UK, France, and Germany combined.

This signals that the world has reorganized itself around artificial intelligence – and everyone is betting on the companies making the chips that power it.

The chip dominance era has begun

Nvidia’s GPUs are the backbone of AI model training. OpenAI (valued at $500 billion) is committing billions to buy Nvidia’s chips. Meanwhile, Nvidia is investing $100 billion in OpenAI to build data centers together.

If this sounds circular, that’s because it is. The major AI players are making deals that funnel money right back to Nvidia. It’s an ecosystem where the chip maker wins no matter what.

But Nvidia isn’t alone. AMD surpassed $400 billion for the first time, riding strategic partnerships with OpenAI and IBM. AMD’s shares climbed 115% year-to-date. Broadcom, tapped for custom AI chip deployments, is up 56%.

Translation: If you’re making anything AI uses, you’re on a vertical climb.

The AI winners extend beyond chips

Palantir, a data analytics platform for predictive insights, has quietly become the world’s 45th most valuable company. The numbers are staggering: up 1,956% since its October 2020 IPO and the best-performing S&P 500 stock since September 2024.

For comparison, the average S&P 500 annual return is about 10%.

Tech dominance is becoming absurd

The world’s 50 most valuable companies have grown larger in 2025. Apple, Microsoft, and Nvidia alone represent over $12 trillion in market value.

Traditional sectors are being dwarfed. Saudi Aramco, the world’s largest oil company, sits at $1.67 trillion, less than half of Nvidia’s value. Energy, once the king of global markets, now plays supporting role to the AI revolution.

What this means

The world is betting everything on AI. Every strategic partnership, every data center investment, every GPU purchase is a bet that artificial intelligence will deliver returns justifying these exponential valuations.

The question is: what happens when that bet gets tested? When growth slows or AI applications don’t deliver promised returns?

See related:

50 Most Valuable Companies 2024

50 Most Valuable Companies 2023

Source: Visual Capitalist, Data current as of October 24, 2025