$10 Trillion Green Gold Rush Is ON

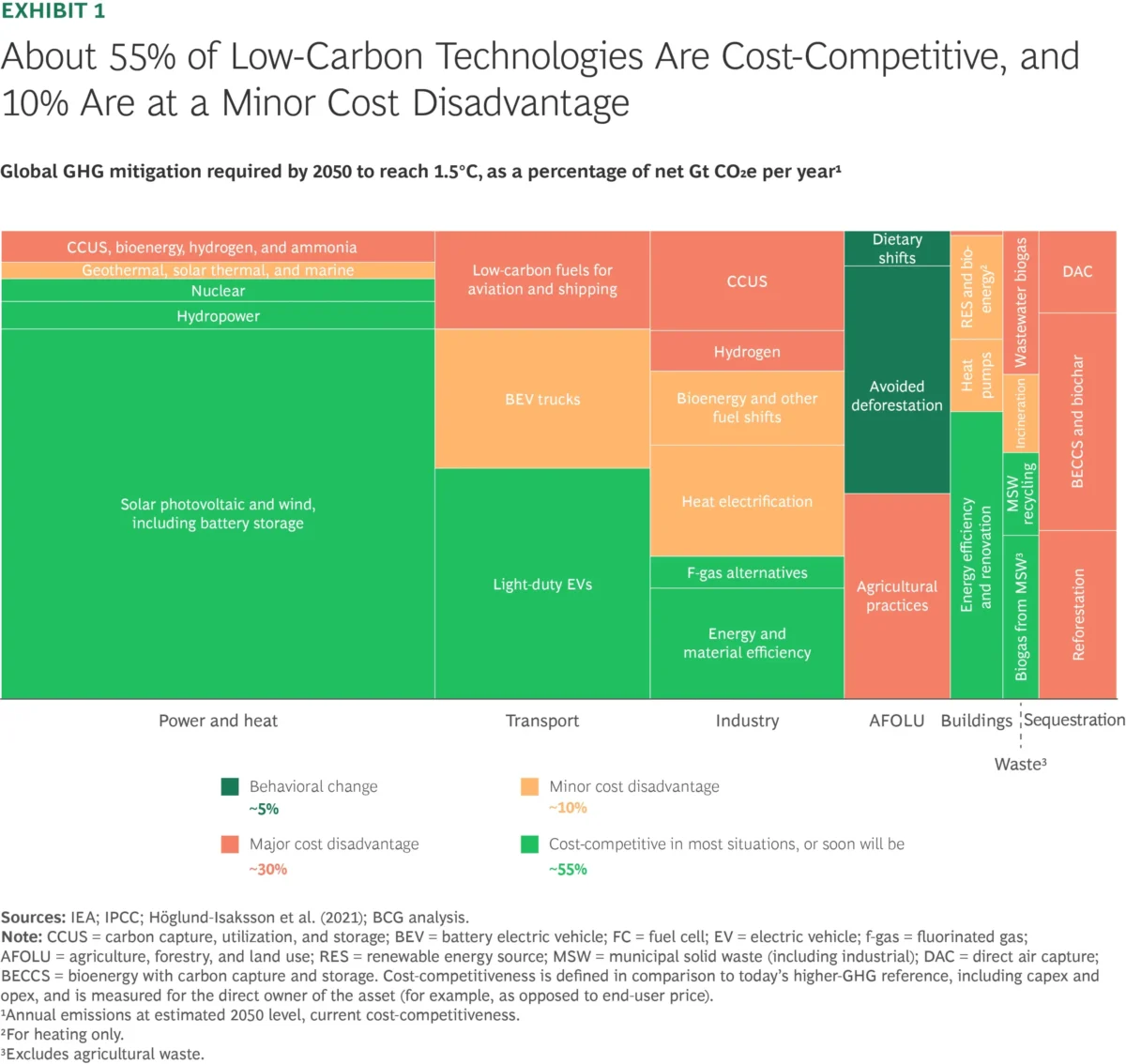

A new report from the Boston Consulting Group (BCG) reveals that, contrary to recent market headwinds, the private capital opportunity in climate investing remains robust and is poised for substantial growth.

The outlook for climate investing is far less gloomy than current news reports suggest, with clear, profitable pathways emerging for investors who employ targeted and sophisticated strategies across the global low-carbon economy.

- The Climate Outlook is Brighter Than You Think: The report counters market pessimism, asserting that the long-term outlook for climate investing remains strong, with abundant, high-return opportunities available for investors with the right execution expertise.

- Infrastructure Investors Target Core Utilities: Key investment segments for infrastructure capital include modernizing electricity grids, deploying utility-scale energy storage, and investing in electric charging infrastructure across Europe, North America, and Asia-Pacific.

- PE Focus Shifts to Software and Servicing: Private Equity firms are prioritizing high-growth areas like carbon measurement and accounting software, industrial green heat solutions, and the installers/service providers vital for deploying solar, wind, and EV-charging technologies.

- Carve-Outs Become the New Deal Flow: Corporate carve-outs are rapidly becoming a major source of transactions, accounting for 15% of all deals in Q1 2024, offering experienced investors a critical avenue to acquire and build attractive climate-related assets.

- The ‘Infra-at-Exit’ Strategy Emerges: A sophisticated investment play involves funding “infra-at-exit” platforms, such as EV-charging networks and battery storage models, which are structured to transition into stable, infrastructure-like businesses over time.

- New Sectors Poised for Acceleration: Emerging and high-potential segments identified for investment include alternative proteins, specialized recycling equipment and operations, and the European markets for flexibility management and sustainable finance solutions.

Visit the BCG website: Read the Report