Data center developers are bypassing traditional utility grids to build onsite power plants to accelerate construction timelines. This shift toward behind-the-meter energy could fast-track AI infrastructure while significantly increasing reliance on natural gas and private energy generation.

Heard in Davos, data centers moving ‘behind-the-meter’

The era of the data center as a simple tenant of the electric grid is ending. In a massive shift heard across the halls of Davos, the world’s largest tech infrastructure developers are no longer waiting for utilities to plug them in. Instead, they are becoming their own power companies.

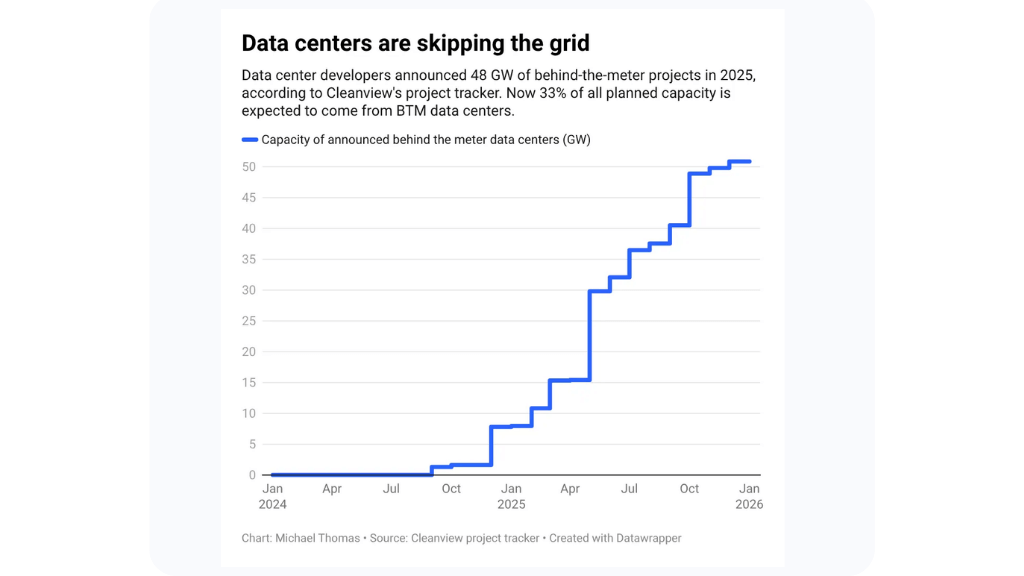

New data from Cleanview reveals a staggering trend: 48 GW of proposed data center capacity -roughly one-third of the entire planned pipeline – is now designed to skip the grid entirely. For context, in late 2024, that figure was less than 2 GW. In just over a year, the industry has pivoted from being a passive consumer to a massive energy producer.

The race for speed over sustainability

The primary driver isn’t a sudden desire to manage complex energy infrastructure. It is pure necessity. In high-demand hubs like Virginia, waiting for a grid connection can take up to seven years. For a startup or a hyperscaler racing to deploy the next generation of AI, seven years is an eternity.

By moving to “behind-the-meter” projects in states with streamlined regulations, developers can slash that wait time to less than two years. The trade-off, however, is often carbon-heavy. While solar, wind, and nuclear are in the mix, natural gas is the dominant choice for 72% of these projects because it provides the constant, reliable “baseload” power these chips require.

Key shifts in the data center landscape

- Massive scale: Projects like the Homer City Energy Campus in Pennsylvania plan to generate 4.5 GW of natural gas power exclusively for onsite servers

- Rapid adoption: Over 40 major projects have announced plans to go off-grid in the last 12 months alone

- Regulatory arbitrage: Development is shifting toward states where permitting for private power plants is faster than waiting for public utility upgrades

- Carbon implications: This trend could create some of the largest single-point sources of CO2 emissions in the country

Why this matters for founders and pros

For those in the tech and energy sectors, this signals a decoupling of industrial growth from public infrastructure. If you are building a company that relies on massive compute, your physical location and energy strategy are now just as important as your software stack. We are entering a phase where the “cloud” is no longer an invisible utility, but a series of massive, self-sustaining industrial power hubs.