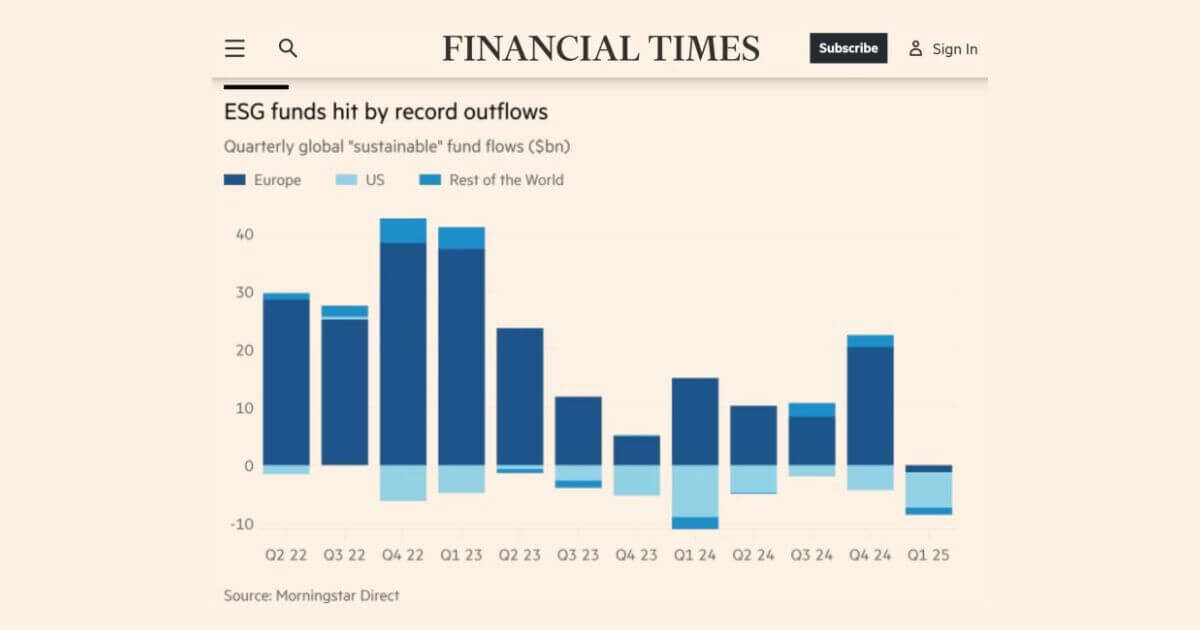

Environmental, social, and governance (ESG) investment funds recorded a rare setback in the first quarter of 2025, with $8.6 billion in net global outflows, according to Morningstar.

This marks the first time Europe, the largest market for ESG funds, has posted a quarterly net outflow — a trend that had already taken root in the U.S., China, and Japan in recent years.

Yet experts caution against reading this as a sign of long-term decline. Here’s why the situation may not be as dire as it seems:

- Europe’s outflow was modest: $1.2 billion in net withdrawals equals just 0.04% of total European ESG assets, which currently stand at $2.68 trillion.

- Other markets are holding steady: Mid-sized regions like Canada, Australia, South Korea, and Taiwan still saw positive ESG fund flows.

- Asset values held firm: Despite the outflows, ESG funds overall retained their asset value better than broader markets.

- Fixed income growth continues: While equities dominate ESG portfolios, green bonds and other sustainable debt instruments are still growing steadily.

The data spans a wide range of funds that claim to be focused on sustainability, impact, or ESG criteria — though the rigor and credibility of that focus varies, a debate that continues within the investment community.

Source: Financial Times